utah state solar tax credit 2020

13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research. Energy Systems Installation Tax Credit.

Understanding The Utah Solar Tax Credit Ion Solar

This bill provides stability for the Utah solar market as it adapts to changes to rate structures and net metering.

. The Production Tax Credit is available for large scale solar PV wind biomass and geothermal electricity generating renewable energy projects over 660 kilowatts nameplate capacity system size. After 2020 the cap will decline by 400 annually and eventually disappear after 2023. The Utah Public Service Commission agreed today to let Rocky Mountain Power reduce the amount of energy credits that people receive in exchange for solar power.

A Secure Online Service from Utahgov. From 2018 to 2021 the maximum credit available for residential solar PV is 25 of eligible costs or 1600 whichever is lower. The Utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is less.

Federal tax credit its technically called the Investment Tax Credit. Federal solar investment tax credit. The maximum Re-newable Residential Energy Systems Credit credit 21 for solar power systems installed in 2021 is 1200.

State Low-income Housing Tax Credit Allocation Certification. The PTC is calculated as 0035 35 per kilowatt hour of electricity produced during the projects first 48 months of operation after the Commercial Operation Date. What Is the Utah Solar Tax Credit Application Process.

Utahgov Checkout Product Detail. 21 Renewable Residential Energy Systems Credit. Your selected contractor can work with you to apply for available incentives and improve your return on investment.

Utah Solar Tax Credit Households in Utah can have up to 25 of their solar installation costs covered by the Utah Solar Tax Credit. 19 Live Organ Donation Expenses Credit. The 2020 legislature passed HB 4003 creating a nonrefund-able tax credit for donations made to the Special Needs.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. The individual income tax credit for residential systems is 25 of the reasonable installed system costs up to a maximum credit of 2000 per residential unit. This is 26 off the entire cost of the.

By Sara Tabin Oct. Renewable Energy Systems Tax Credit Application Fee. Thats in addition to the 26 percent federal tax credit for solar not a bad deal for a system that can.

Do not send this form with your return. 08 Low-Income Housing Credit. Utah Code 59-10-1106 Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp.

Renewable Energy Systems Tax Credit. You can claim 25 percent of your total equipment and installation costs up to 800. Rooftop solar installations are eligible for a Federal Tax credit and a state tax credit.

Renewable energy systems tax credit. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. These incentives began to step down in 2020 and will expire in 2024 learn more about tax incentives.

We are accepting applications for the tax credit programs listed below. Utah has a state tax credit for solar. When customers purchase a system this state tax credit is credited toward Utah state taxes owed and deducted from the solar costs.

Utah customers may also qualify for a state tax credit in addition to the federal credit. 350 North State Suite 320 PO Box 145115 Salt Lake City Utah 84114 Telephone. Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes.

Application fee for RESTC. QUALIFYING FOR THE UTAH SOLAR TAX CREDIT. SB 141 Electric Energy Amendments.

Utah Solar Tax Credit Expiration Changes. Your Cart Your Cart. This form is provided by the Utah Housing Corporation if you qualify.

This amount decreases by 400 each year after until it expires. In 2020 the maximum tax credit was 1600 while in 2021 the maximum credit was 1200. You can apply for the Utah solar tax credit yourself or ask your solar installer to gather and complete the necessary steps.

This perk is commonly known as the ITC short for Investment Tax Credit. Welcome to the Utah energy tax credit portal. 12 Credit for Increasing Research Activities in Utah.

Passed This bill preserves the Utah State Solar Tax Credit at 1600 through 2020 and is a huge advantage for residential solar installers. This form is provided by the Office of Energy Development if you qualify. All of our customers with a taxable income qualify for the US.

17 Credit for Income Tax Paid to Another State. Solar PV systems installed on your home or business. Extends a 1600 cap on maximum credits under the current credit system for residential PV systems until 2020.

31 2020 12. We hoped this bill would be easy but it ended up being an incredible lift on the last two days of the session to get passed. Log in or click Register in the upper right corner to get started.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Utah. Formally known as Renewable Energy Systems Tax Credit this residential solar incentive will cover 1600 of the cost of a solar panel installation until December 31 2020. Until December 21 2020 this tax credit covers the lesser of 25 percent or 1600 of any residential solar panel array.

Solar Energy Systems Phase-out. Special Needs Opportunity Scholarship Program.

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Understanding The Utah Solar Tax Credit Ion Solar

Solar Incentives In Utah Utah Energy Hub

Custer State Park In South Dakota Get An Up Close Look At 1 300 Wild Bison And Hike Dramatic Granite Spires At This Custer State Park State Parks Sylvan Lake

Handing Over Money Isolated On A White Background Ad Money Handing Isolated Background White Ad Writing Crafts Solar Projects Clean Energy

Medical Tourism In Ho Chi Minh City Potential Yet Inadequate Medical Tourism Tourism Tourism Department

Tru Tone Finishing Creating 120 Jobs In Kentucky Automotive Businessclusterscorridors Capitalinvestment Dailynews Kentucky Lexington Kentucky Job

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

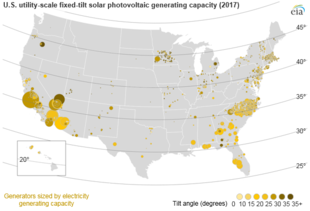

Solar Power In The United States Wikiwand

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

What Solar Incentives Do I Qualify For Solar Tribune

A Solar Eclipse With A Green Planet Solar Eclipse Facts Solar Eclipse Live Solar Eclipse Activity

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Arkansas Drove Across This State With Jeff And Hope On Rode Trip To See Cody Graduate Basic Training Arkansas Map Of Arkansas Little Rock

Pin On Mapas Para Ninos Imprimibles Gratis

Net Metering In The United States Wikipedia